Yes! You can use AI to fill out Form W-4, Employee's Withholding Certificate

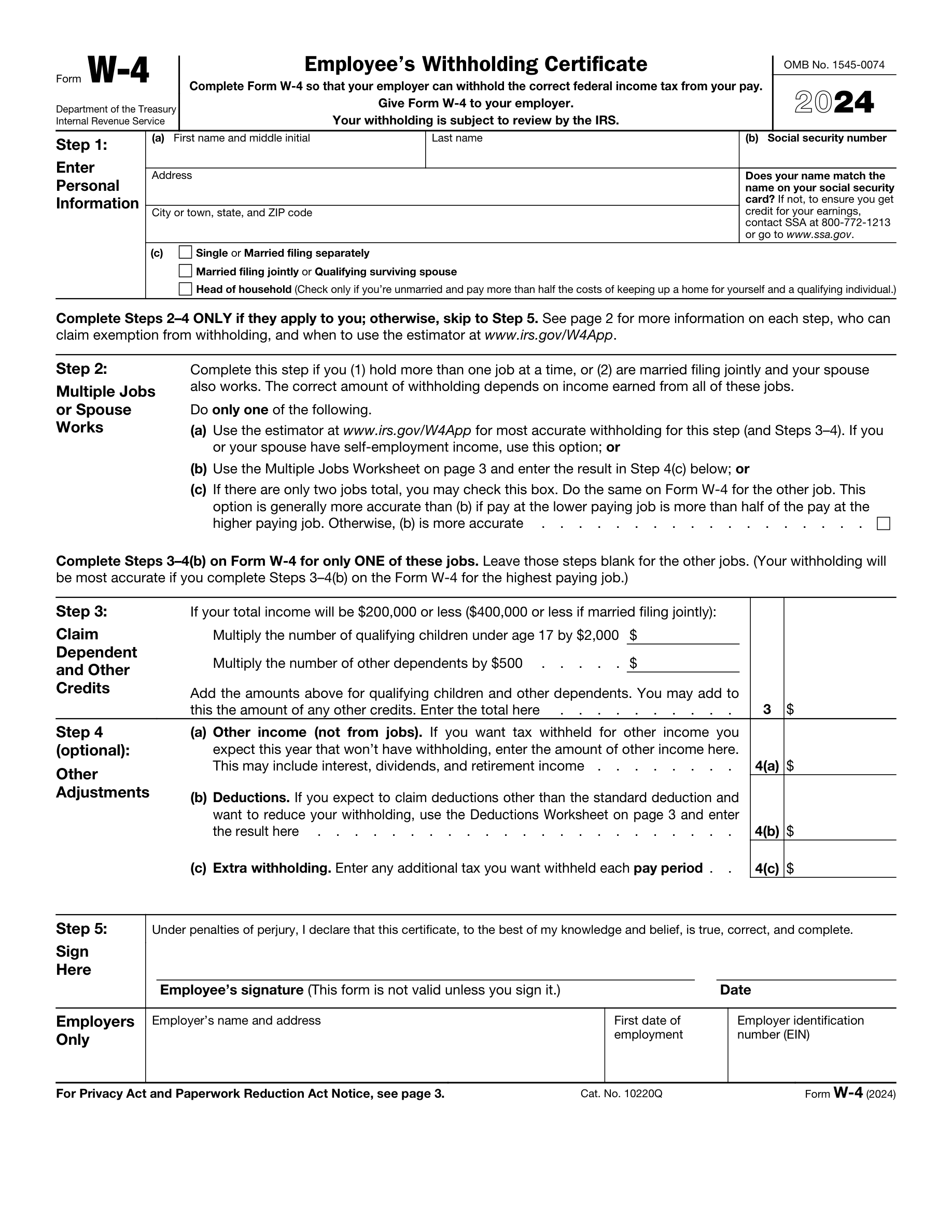

Form W-4, Employee’s Withholding Certificate, is essential for employees to communicate their tax situation to their employer. This form helps determine the correct amount of federal income tax to withhold from paychecks, preventing underpayment or overpayment of taxes.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out W-4 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form W-4, Employee's Withholding Certificate |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 29 |

| Number of pages: | 4 |

| Version: | 2024 |

| Form page: | http://irs.gov/forms-pubs/about-form-w-4 |

| Official download URL: | https://www.irs.gov/pub/irs-pdf/fw4.pdf |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out W-4 Online for Free in 2025

Are you looking to fill out a W4 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2025, allowing you to complete your W4 form in just 37 seconds or less.

Follow these steps to fill out your W4 form online using Instafill.ai:

- 1 Visit instafill.ai site and select W-4.

- 2 Enter personal information in Step 1.

- 3 Complete Steps 2-4 if applicable.

- 4 Sign and date the form electronically.

- 5 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable W-4 Form?

Speed

Complete your W-4 in as little as 37 seconds.

Up-to-Date

Always use the latest 2025 W-4 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form W-4

Form W-4 is an Employee's Withholding Certificate used by employees to provide their employers with the necessary information to withhold the correct federal income tax from their pay. It is essential to ensure the correct amount of tax is withheld to avoid penalties and potential underpayment of taxes.

Form W-4 requires employees to provide their name, address, social security number, and filing status. It is important to ensure this information is accurate to avoid any potential issues with tax withholding.

Step 1 of Form W-4 is where employees provide their personal information, including their name, address, social security number, and filing status. This information is used to determine the standard deduction and tax rates for calculating withholding.

Step 2 of Form W-4 is for employees who have more than one job or are married filing jointly and both spouses work. It is necessary to calculate the correct amount of withholding for all jobs to avoid underpayment of taxes.

Step 2(a) of Form W-4 uses the IRS withholding estimator to calculate the correct amount of withholding for multiple jobs. Step 2(b) uses a worksheet to calculate the additional tax for the lower paying job and add it to the withholding for the higher paying job.

Step 3 of Form W-4 is where employees can claim any dependent and other credits they may be eligible for. These credits can reduce the amount of tax withheld and increase the employee's take-home pay.

Step 4 of Form W-4 is optional and allows employees to make additional adjustments to their withholding. This can include other income, deductions, or extra withholding to ensure the correct amount of tax is paid throughout the year.

The Deductions Worksheet in Form W-4 is used to calculate the amount of deductions an employee may claim, which can reduce their taxable income and the amount of tax withheld. This worksheet should only be completed if the employee expects to claim deductions other than the standard deduction.

The Multiple Jobs Worksheet in Form W-4 is used to calculate the additional tax that should be withheld for a lower paying job when an employee has more than one job. This worksheet helps ensure the correct amount of tax is withheld for all jobs to avoid underpayment of taxes.

Employees should submit Form W-4 to their employer as soon as possible, but no later than the first payday after they begin work. Employers are required to start withholding taxes based on the information provided on the Form W-4.

If an employee fails to provide a completed Form W-4 to their employer, the employer is required to treat the employee as if they are single with no other entries on the form. This could result in too little tax being withheld and potential penalties when filing taxes.

Compliance W-4

Validation Checks by Instafill.ai

1

Ensures that the first name and middle initial are provided and match the social security card

The AI ensures that the first name and middle initial fields are not left blank and that they correspond exactly to the information on the individual's social security card. It checks for any discrepancies between the provided names and the official records to prevent issues with tax withholding accuracy. The AI also alerts the user if the middle initial is missing when it is present on the social security card, ensuring full compliance with identification requirements.

2

Confirms that the last name is entered and matches the social security card

The AI confirms that the last name is entered into the appropriate field and verifies its match against the last name on the social security card. This validation is crucial as it ensures that the withholding certificate is accurately associated with the correct taxpayer record. The AI cross-references the entered data with the social security administration's records to maintain consistency and to avoid potential legal or processing complications.

3

Verifies that the address is complete, including city or town, state, and ZIP code

The AI verifies that the address provided on the withholding certificate is complete, including the city or town, state, and ZIP code. It checks for any missing components or incorrect entries that could lead to mail delivery issues or misfiled tax documents. The AI also ensures that the address format conforms to USPS standards, which is essential for accurate and timely correspondence regarding tax matters.

4

Checks that the social security number is entered correctly

The AI checks that the social security number (SSN) provided on the form is entered correctly. It validates the SSN format and confirms that it consists of nine digits, often formatted as XXX-XX-XXXX. The AI also performs a checksum validation to detect any input errors. Ensuring the accuracy of the SSN is critical as it is the primary identifier for the taxpayer in the IRS's records.

5

Confirms that the correct filing status box is checked

The AI confirms that one, and only one, of the correct filing status boxes is checked on the withholding certificate. It includes options such as Single, Married filing separately, Married filing jointly, Qualifying surviving spouse, or Head of household. The AI ensures that the selected status accurately reflects the taxpayer's current situation, as this affects the calculation of withholding taxes. It also checks for any inconsistencies or multiple selections that could invalidate the form.

6

Validates that Step 2 is completed if the employee has multiple jobs or if married filing jointly and the spouse works

The AI ensures that Step 2 of the Employee's Withholding Certificate is properly filled out when the employee holds multiple jobs or is married filing jointly with a working spouse. It checks for the appropriate selection of checkboxes or entries that indicate the employment situation. The AI also prompts the user to provide additional information if the section is not completed but should be, based on the marital and job status provided elsewhere in the form.

7

Ensures that the IRS estimator is used or the Multiple Jobs Worksheet is completed if applicable

The AI confirms that the employee has either used the IRS Tax Withholding Estimator or completed the Multiple Jobs Worksheet when required. It verifies that the correct figures from these tools are entered into the form. If the AI detects that this step is necessary but not completed, it will alert the user to take the appropriate action to ensure accurate withholding.

8

Verifies that the box in Step 2(c) is checked if there are only two jobs total

The AI checks that the box in Step 2(c) of the Employee's Withholding Certificate is marked when the employee and their spouse (if married filing jointly) have a total of two jobs between them. It ensures that this step is not overlooked, as it is crucial for accurate tax withholding. The AI also cross-references the total number of jobs reported to confirm the validity of this selection.

9

Calculates the credits for dependents accurately if total income is within the specified threshold

The AI calculates the credits for dependents as stated in the Employee's Withholding Certificate, ensuring that the total income falls within the specified threshold for eligibility. It cross-checks the number of dependents and the total income reported to determine the correct amount of credits. The AI also alerts the user if there is a discrepancy in the calculation or if the income exceeds the threshold, potentially affecting the credit amount.

10

Confirms that any other income not from jobs is entered in Step 4(a)

The AI confirms that any additional income not derived from jobs, such as interest, dividends, or retirement income, is accurately reported in Step 4(a) of the Employee's Withholding Certificate. It ensures that this income is not omitted, as it can affect the withholding amount. The AI also provides guidance on where to include this information on the form and checks for consistency with other entries that may indicate additional sources of income.

11

Deductions Worksheet Calculation

Ensures that if an employee opts to claim deductions greater than the standard deduction, the Deductions Worksheet is utilized to calculate the precise amount. This check involves confirming that all necessary fields on the worksheet are completed accurately and that the final deduction amount is correctly transferred to the corresponding field in the Employee's Withholding Certificate.

12

Additional Tax Withholding Entry

Verifies that any additional amount of tax an employee wishes to have withheld from each paycheck is properly entered in Step 4(c) of the form. This validation ensures that the employee's intention for additional withholding is clearly indicated and that the value entered is numeric and within a reasonable range based on typical withholding amounts.

13

Signature and Date Verification

Checks that the Employee's Withholding Certificate is duly signed and dated by the employee in Step 5. This validation confirms the authenticity and intent of the employee to submit the form as a binding document, and that the date of signing falls within an acceptable timeframe from the date of submission.

14

Exemption Claim Verification

Confirms that the word 'Exempt' is written below Step 4(c) if the employee is claiming exemption from withholding. This check is crucial to ensure that the employee's claim for exemption is explicitly stated, and that no withholding amounts are entered in the fields that would contradict the exemption claim.

15

Exemption Submission Deadline

Verifies that a new Form W-4 is submitted by February 15, 2025, if the employee claims exemption from withholding. This validation ensures compliance with the IRS requirement that employees claiming exemption from withholding must re-submit Form W-4 each year to maintain their exempt status.

Common Mistakes in Completing W-4

It is crucial to use the exact name as it appears on your social security card when filling out the Employee's Withholding Certificate. Mismatched names can lead to processing delays and potential issues with your tax records. To avoid this mistake, double-check your social security card before completing the form. Ensure that every detail, including middle initials and suffixes, if applicable, is accurately reflected.

Entering an incorrect social security number (SSN) on the Employee's Withholding Certificate can result in significant problems, such as incorrect earnings records and issues with your tax return. To prevent this error, carefully enter your SSN and verify it against your social security card. If you have recently changed your name, for example, due to marriage or divorce, make sure your social security record is updated before filling out the form.

Selecting the incorrect filing status on the Employee's Withholding Certificate can affect the amount of tax withheld from your wages, potentially leading to underpayment or overpayment of taxes. Review the definitions of each filing status provided in the form's instructions to ensure you make the correct choice. If you are unsure about your filing status, consult with a tax professional or use the IRS Tax Withholding Estimator for guidance.

If you hold more than one job at the same time or are married filing jointly and your spouse also works, it's important to complete Step 2 on the Employee's Withholding Certificate. This step ensures that the correct amount of tax is withheld based on the total income from all jobs. To avoid underwithholding, use the IRS's online Tax Withholding Estimator or the Multiple Jobs Worksheet provided with the form to calculate the correct withholding amount.

Using the Multiple Jobs Worksheet incorrectly can lead to inaccurate withholding amounts. This mistake often occurs when the instructions are not followed carefully or when the information from the highest paying job is not used in the calculations. To avoid this, read the instructions for the Multiple Jobs Worksheet thoroughly and use the figures from your highest paying job when completing the worksheet. If you are unsure about how to fill it out, consider seeking assistance from a tax professional.

Incorrectly claiming dependents in Step 3 can lead to inaccurate withholding, affecting the employee's tax liability. It is crucial to understand the eligibility criteria for claiming dependents as outlined by the IRS. Taxpayers should review the requirements for dependents, such as relationship, age, and residency tests, before completing this section. To avoid this mistake, double-check the IRS guidelines for dependents and ensure that all information matches the criteria before claiming them on the form.

Miscalculating the credits for dependents can result in either overpaying or underpaying taxes. It is important to accurately calculate the credit amount for each qualifying dependent as per the current tax year's guidelines. Taxpayers should use the Child Tax Credit and Credit for Other Dependents Worksheet provided by the IRS to determine the correct amounts. To prevent errors, carefully follow the instructions on the worksheet and verify all calculations before entering the amounts on the form.

Failing to include other income in Step 4(a) can lead to underreporting of income and potential penalties. This step is designed for reporting income that is not subject to withholding, such as interest, dividends, and retirement income. Employees should gather all sources of income and accurately report them in this section. To ensure accuracy, maintain records of all income received throughout the year and consult with a tax professional if there is uncertainty about what constitutes other income.

Neglecting to use the Deductions Worksheet for additional deductions can result in a missed opportunity to reduce taxable income. This worksheet helps employees calculate itemized deductions or other adjustments to income. Before completing this step, review the instructions for the Deductions Worksheet and determine if itemized deductions are more beneficial than the standard deduction. To avoid this mistake, carefully itemize and calculate deductions according to the worksheet's guidelines and include them on the form if they exceed the standard deduction.

Entering an incorrect amount of additional tax to withhold in Step 4(c) can cause discrepancies in the employee's tax withholding. This step allows employees to specify an additional withholding amount per pay period. To avoid errors, consider using the IRS Tax Withholding Estimator or consult with a tax professional to determine the appropriate additional withholding amount. Ensure that the specified amount aligns with your tax liability goals, such as avoiding a large tax bill or receiving a smaller refund.

The Employee's Withholding Certificate requires a signature and date to be considered valid. A missing signature or date can lead to the form being rejected or not processed, which may result in incorrect tax withholding. To avoid this mistake, double-check the form before submission to ensure that all required fields, including the signature and date, are completed. It is also advisable to review the form for accuracy and completeness as a final step.

Each section of the Employee's Withholding Certificate provides important information for accurate tax withholding. Failing to complete all relevant sections can lead to incorrect withholding amounts and potential tax liabilities. To prevent this, carefully read the instructions for each step and provide all necessary information. If unsure about how to fill out a section, seek guidance from a tax professional or the IRS resources available online.

To claim exemption from withholding, the word 'Exempt' must be written below Step 4(c) on the Employee's Withholding Certificate. Omitting this step can result in the exemption not being recognized and taxes being withheld. Employees who qualify for exemption should ensure they follow the instructions precisely and verify that 'Exempt' is clearly written on the form. It is also important to remember that claiming exemption applies only if the employee meets certain conditions, which should be reviewed annually.

Tax laws and forms are subject to change, and using an outdated Employee's Withholding Certificate, especially when claiming exemption, can lead to processing delays or errors. To avoid this, always use the most current form available from the IRS website. Check the form's revision date, usually located in the top left corner, to ensure it is the latest version. Additionally, exemptions must be claimed each year by February 15, so timely submission of the updated form is crucial.

The Employee's Withholding Certificate requires accurate personal information that matches the records of the Social Security Administration (SSA). Discrepancies between the form and SSA data can cause issues with tax records and potential mismatches. To prevent this, employees should update their personal information with the SSA, such as name changes due to marriage or divorce, before completing the form. Regularly checking and updating personal information with the SSA ensures smooth processing of tax-related documents.

Providing an incorrect address, city, or ZIP code on the Employee's Withholding Certificate can lead to significant issues, such as delayed or misdirected correspondence and tax documents. To avoid this mistake, double-check the accuracy of your address information against a recent utility bill or bank statement before submitting the form. Ensure that all details are current and correctly spelled. If you have recently moved, update your records with the USPS and other relevant institutions to ensure consistency across all documents.

Failing to check the correct box for multiple jobs in Step 2(c) can result in inaccurate withholding, potentially leading to an unexpected tax bill or a smaller refund. To prevent this error, carefully read the instructions for Step 2(c) if you hold more than one job at the same time or are married filing jointly with a working spouse. Use the IRS's Tax Withholding Estimator or the Multiple Jobs Worksheet provided with the form to determine the appropriate box to check. Regularly review your withholding whenever there is a change in employment to ensure it remains accurate.

If you claim exemption from withholding on the Employee's Withholding Certificate, you must submit a new Form W-4 by February 15, 2025, to maintain your exempt status. Neglecting to do so may result in tax being withheld from your paycheck when it is not necessary. To avoid this oversight, set a reminder at the start of each year to review your withholding status and submit a new Form W-4 if your exemption will continue. Keep a record of when you claim exemption and be proactive in understanding the IRS guidelines regarding exemption qualifications.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out W-4 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills w4 forms, ensuring each field is accurate.